© Turkuvaz Haberleşme ve Yayıncılık 2024

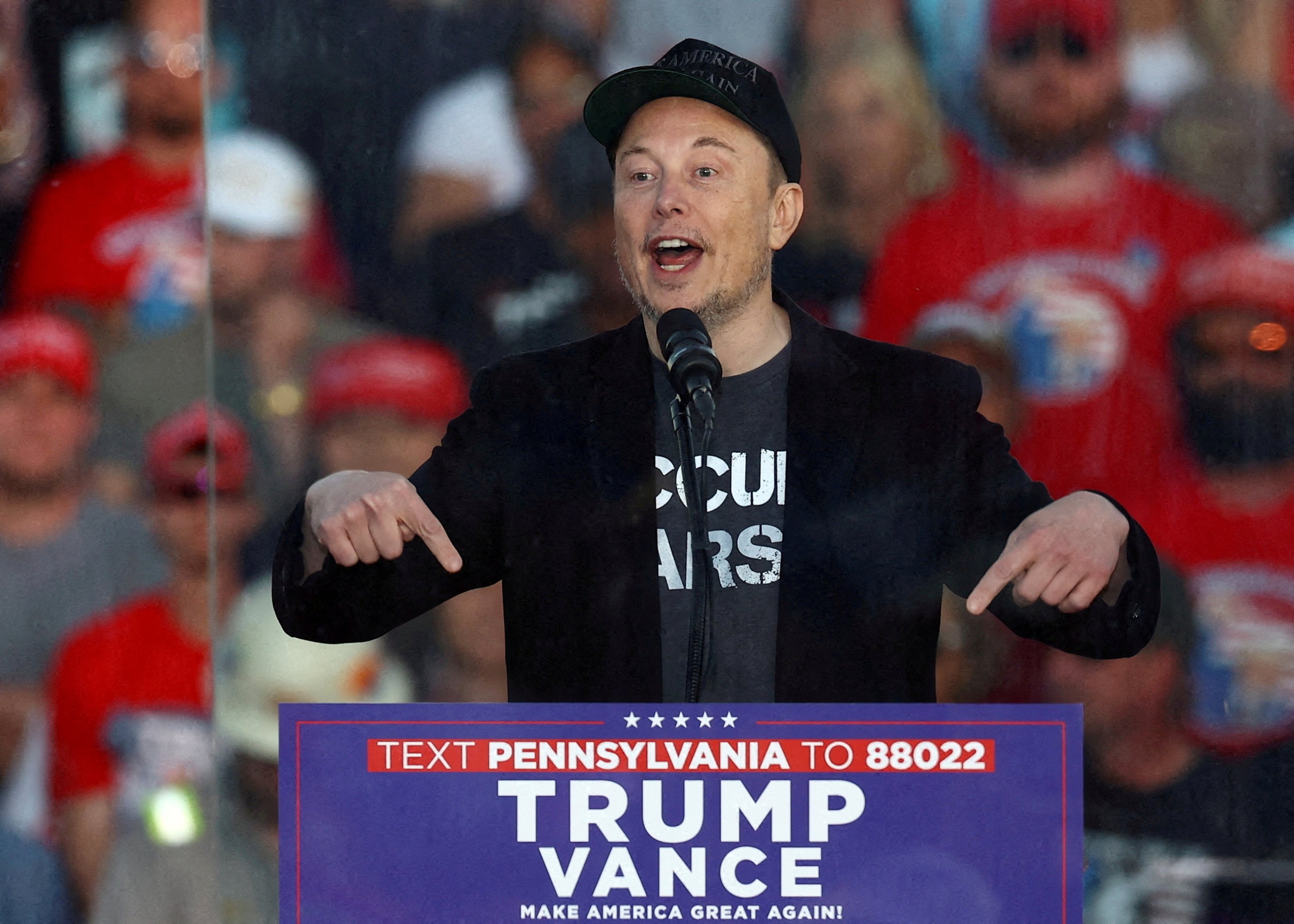

"Elon Musk's gamble on Donald Trump pays off," is the headline that prominent British daily the Financial Times featured on Nov. 6, just after U.S. elections in which Trump secured his return to the White House as the nation's 47th president.

"Trump's win ushers in new era for Musk," the report said adding: "whose gamble on a knife-edge U.S. election paid off as he is set to become one of the incoming president’s most influential political and business advisers."

It further delved into a close relationship between Musk and Trump, as did many articles since then.

Much of the debate was concentrated around the role of Musk-owned social media platform X in elections and concerns over disinformation even coming from the billionaire himself.

Yet, Elon Musk triumphed strongly, further solidifying the top spot as the richest person alive having his fortune soaring above $300 billion.

According to the current Forbes billionaire list, Musk leads ahead the second on the list, Larry Ellison, co-founder of Oracle, with close to $80 billion more in net worth.

"Game, set and match," Musk said on Nov. 6, in just one of countless posts he shared on X following the elections. And a week after, President-elect Trump has given him a role to co-lead a newly formed "Department of Government Efficiency," or popularly "DOGE."

Shifting from Silicon Valley tech leader, Musk earlier this year announced plans to move his companies X and SpaceX to Texas and now he appears to follow Trump in his meetings with other leaders such as President of Argentina Javier Milei.

His political ascendancy left doors to questions varying from "What happens to Elon Musk's companies after he takes in role in DOGE?" to "Is there a conflict of interest,"? and just in recent days, Reuters reported that two Democratic senators were calling for a probe into Musk's alleged Russia calls.

Several Democratic lawmakers have publicly called for a probe into Musk's communications with Moscow since a Wall Street Journal (WSJ) report last month on the alleged contact.

The concerns originate from the fact that Musk is the CEO of SpaceX company, one of the main contractors to NASA.

Another significant domain is Musk's role as the owner of X, which he famously acquired in 2022.

And although many reports in the recent period following the elections suggested that the popularity of X is waning as many users shift to platforms such as Bluesky, Reuters reported on Saturday, citing sources that some Wall Street banks were reportedly hoping they may soon be able to offload $13 billion of debt that backed the billionaire's purchase of X.

Some of the lenders in the consortium, which included Morgan Stanley and Bank of America, think Musk's emergence as a close aide to Trump could boost the prospects of X, previously known as Twitter, the sources said.

If that were to happen, it would allow them to sell the debt without having to take a massive loss on the deal, the sources said.

Musk, X, Morgan Stanley and Bank of America did not immediately respond to a request for comment.

Banks typically sell such loans to investors soon after the deal is done, but in the case of X, which Musk bought for $44 billion in 2022, they have been stuck holding the debt.

In recent months, one of the sources said, some banks expected X had seen increased traffic as users flocked to the platform around big events like the U.S. elections.

Trump, whose account on the platform was restored by Musk after the previous management banned him in January 2021, has been regularly posting on it.

The banking sources said they wanted to see whether that and a robust U.S. economy would translate to increased revenues for the platform.

Analysts have said Musk's ties with Trump – who put him in charge of a new department on efficiency – could benefit the entrepreneur's various business ventures, which range from Tesla electric vehicles to SpaceX rockets.

In fact, Tesla's market value surpassed $1 trillion for the first time in two years in the days after the election results. Some have also voiced optimism on potential of easing regulations on self-driving technology, which could boost prospects of Tesla's newly unveiled vehicles such robotaxi.

Yet, it is still unclear to what extent Musk's close connection with the new administration could help revive X's business. One of Reuters' sources said it could also further divide its user base.

Newer platforms like Bluesky and Meta's Threads have been benefiting from a user exodus from X since the election.

U.S. web traffic on X reached its highest point this year on Election Day with 42.3 million visits, which climbed another 10% to 46.5 million visits the day after the election, according to data from web analytics company Similarweb.

But by the weekend, X's web traffic tapered off to more normal levels, Similarweb said.

The data firm said 115,000 web users in the U.S. deactivated their X account on Nov. 6, higher than any other day since Musk took over the platform.

Prominent accounts with large followings on X have left the platform following Trump's election such as former CNN anchor Don Lemon and bestselling U.S. author Stephen King.

"I'm leaving Twitter. Tried to stay, but the atmosphere has just become too toxic. Follow me on Threads, if you like," the horror author wrote on X on Nov. 14.

Moreover, British center-left daily The Guardian had announced it would no longer post content from its official accounts on X, calling it "toxic," which also led to several other outlets and watchdogs to announce their departures from the platform.

The social media company is on the other hand, expected to report its latest finances to the lending consortium in the weeks after the quarter ends next month, the sources told Reuters.

The banks could then decide whether they should continue holding onto the debt or look to engage investors on it, the sources said.

Apart from the ownership of X, and being chief executive of Tesla and SpaceX, Musk in a recent year or so is spearheading another significant venture, namely his artificial intelligence company xAI.

In the postelection whirlwind, the U.S. media reports said xAI was raising up to $6 billion at a $50 billion valuation to acquire 100,000 Nvidia chips, per sources familiar with the situation.

Announced in mid-2023, xAI released a chatbot called Grok last November and it's trying to position itself in the market widely dominated by OpenAI's ChatGPT, Microsoft's Copilot, Antrophic's Claude and startups like Perplexity.

Musk, who was also one of the co-founders of OpenAI, stepped up his ongoing feud with the company as he accused it, along with the tech giant Microsoft of operating a monopoly in an amended legal complaint on Thursday.

It follows previous lawsuits accusing the firm of breaching the principles he agreed to when he helped found it in 2015, mainly of keeping it a nonprofit entity.

"Never before has a corporation gone from tax-exempt charity to $157 billion for profit, market-paralyzing gorgon – and in just eight years," Musk claimed in a lawsuit filed with Northern District of California.

Now, with Musk's active role in the new administration of Trump, it remains to be seen what would be major next steps when it comes to AI regulation, which is a source of wider societal concern among the proliferation of deepfakes, the potential for losses of jobs and negative environmental impacts.

The pledges of Trump's campaign included various vows from "ending inflation" to "canceling the electric vehicle mandate and cutting costly and burdensome regulations," so it appears as likely that Trump could have a different position on AI from his predecessor Joe Biden, who issued U.S.' first AI executive order, requiring safety assessments, civil rights guidance and research on labor market impact.

At the same time, the last two weeks and the election of Trump also spurred an unprecedented cryptocurrency rally and new records for the market's top currency Bitcoin, making it a desirable asset, while prices of gold slightly eased.

With Musk's extensive business sphere, which includes top companies operating in areas from social media, space and automotive to artificial intelligence, it is clearly possible that these firms could avail in some extent by any major shift in policies although at the moment it remains to be seen how it would all play out.