© Turkuvaz Haberleşme ve Yayıncılık 2024

Türkiye outpaced other European nations in the number of seed stage deals from January through September of this year, largely due to the influence of the Scientific and Technological Research Institution of Türkiye's (TÜBITAK) BiGG Fund.

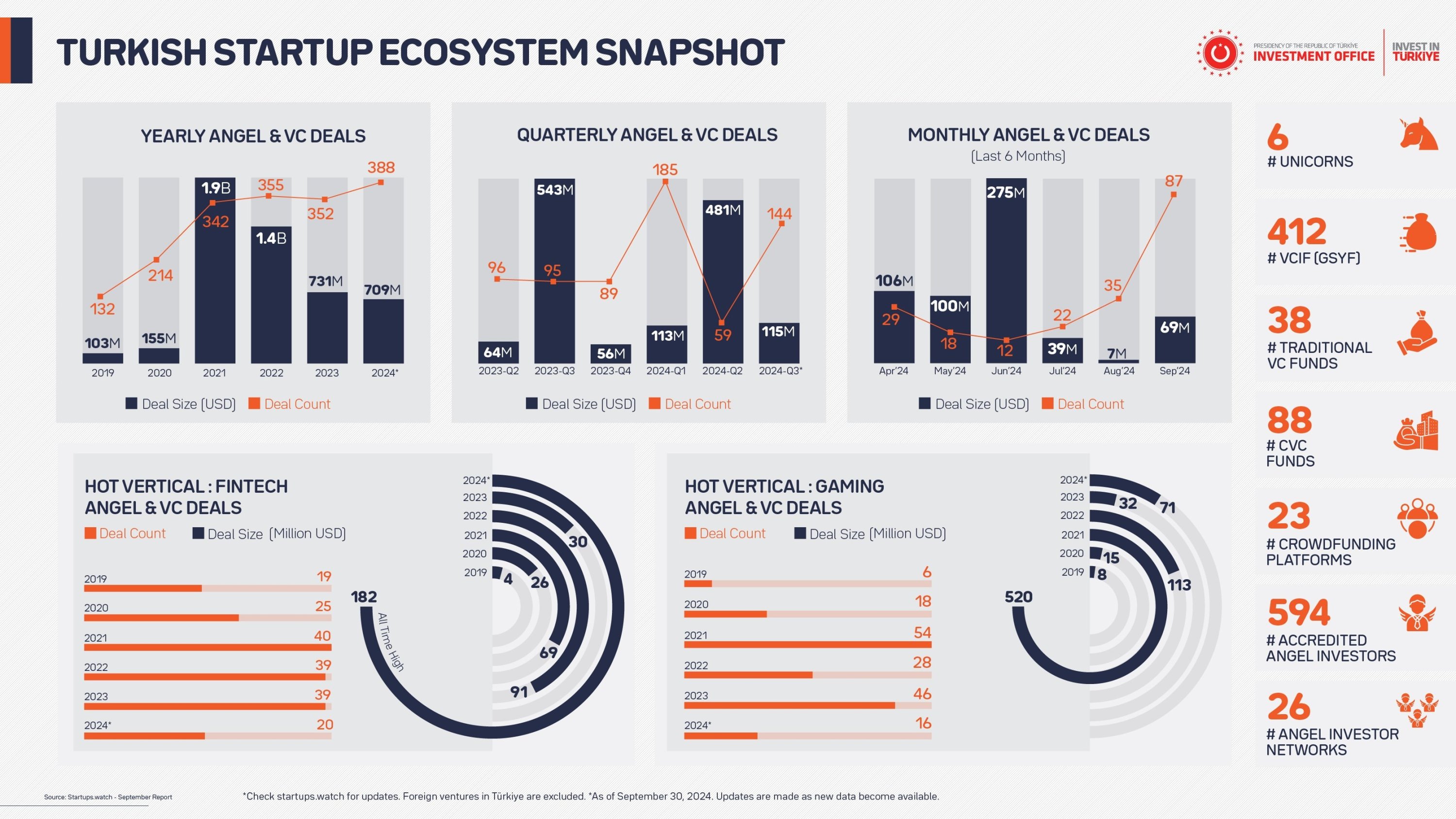

The data by industry monitor startups.watch showed some 388 investment agreements worth $709 million were signed in the first three quarters of 2024, with 81% of that funding going to nine ventures that raised $20 million or more each.

Out of the total, 247 deals were seed investments, according to the data. And some 228 were backed by the TÜBITAK BiGG Fund, formerly a grant and now a seed and pre-seed fund.

The figures, unveiled during an event in Istanbul this week, clearly show that Türkiye provides serious support, especially for early-stage initiatives, and its intention to grow the entrepreneurial ecosystem.

Out of the 388 investments, 55 involved corporate or corporate venture capital (CVC) investors, signaling growing interest from corporate players in Türkiye’s entrepreneurial scene.

Türkiye now has 89 CVCs, indicating increasing corporate participation.

The country has seen notable growth in various sectors, including financial technology, or fintech, gaming, biotechnology, artificial intelligence (AI) and health technologies. The investments in these fields highlight Türkiye’s openness to technological innovation.

Sectors such as fintech and gaming have particularly stood out with significant investments so far this year.

The TÜBITAK BiGG Fund’s contribution to Türkiye’s leadership in seed investments is complemented by the rising interest of CVCs and corporate investors, which is expected to drive the ecosystem’s future growth.

2024 has been a record-breaking year for the fintech sector, which attracted substantial investments, including significant rounds for companies like Colendi, Dgpays, Midas and Sipay.

Globally, fintech startups received $28.5 billion in investment, with Türkiye accounting for just 0.6%, reflecting room for further growth despite the domestic surge in activity.

The TÜBİTAK BiGG Fund has been instrumental in three significant shifts:

Support for women entrepreneurs: A substantial portion of the fund has gone toward women-led ventures. Out of the 388 investments made in 2024, 111 were directed at women entrepreneurs, marking a notable increase and bringing the share to 29%, the highest in five years.

Growth in AI: The fund has played a pivotal role in supporting AI startups, with $14 million invested in AI ventures during 2024. AI continues to grow at the seed and early stages in Türkiye, with TÜBİTAK BiGG Fund leading in AI investments.

Health and biotechnology sectors: The fund has also focused on driving innovation in biotechnology and health technologies, contributing to Türkiye’s strategic progress in these fields.

With 16 deals amounting to $70.9 million in investment, Türkiye was the second-largest recipient of gaming industry investments in Europe in the first nine months, just behind the United Kingdom.

Although gaming investments have declined compared to the record highs of 2021, the sector remains a key area of interest due to its ongoing potential.

Despite breaking records in the number of deals, Türkiye’s total investment amounts remain relatively low.

TÜBİTAK BiGG Fund is playing a central role in growing the ecosystem, particularly in strategic sectors like biotechnology, AI, health technologies and electronics. Besides, it also makes important contributions in terms of Türkiye’s global competitiveness, supporting women entrepreneurs and diversifying the ecosystem.

However, foreign investments have decreased, and the majority of activity has been driven by domestic funds.

“The investments of foreign investors in the venture ecosystem have decreased. Investment funds other than the TÜBITAK BiGG Fund remained silent during this period. While angel networks have grown in number, only two were actively involved during this period. Angel investment networks have remained silent. Apart from the TÜBITAK BiGG Fund, which has been involved in 228 seed deals, investments at this stage have been relatively muted,” startups.watch founder Serkan Ünsal said.

“It is also necessary to divide artificial intelligence investments into two. It is necessary to separate the enterprises with artificial intelligence in their focus and those that are supported by artificial intelligence, that is, those that use artificial intelligence applications in their business. When you look at it like this, the total investment remained at the level of $ 14 million,” Ünsal noted.

Elif Altuğ, general manager and board member of the Türkiye Development Fund (TKYB), explained that TÜBITAK's investments are made not through grants but by acquiring a 3% equity stake in startups.

Addressing the startups.watch event, Altuğ stressed this approach is designed to prepare startups for future investor negotiations

She emphasized that Türkiye’s top position in Europe in the number of seed investments is no coincidence, stating, "We have created structures that ensure startups receive support at every stage, from seed to Series A. We are working hard to equip startups with the skills to operate globally."

She also highlighted that while the TÜBITAK BiGG focuses on seed-stage funding, the TKYB Upper Fund, established in July, aims to support startups beyond seed and into Series A and later stages by collaborating with experienced investors.

Segmentify, an AI software platform backed by Türk Telekom’s venture capital arm, TT Ventures, is gaining attention for its AI-powered customer engagement solutions. These solutions allow companies to offer exclusive campaigns and products to their customers.

Segmentify co-founder Ergin Eroğlu highlighted the importance of building customer trust during his speech at the startups.watch evet.

"What we offered had no market equivalent. We created the market. It took time to convince customers, but once fully integrated, the system worked flawlessly. Each new customer helped us grow further. Türk Telekom not only used the products we developed but also helped us reach small and medium-sized businesses (SMEs). They became more than just investors," said Eroğlu.

Beyond financial investments, Türk Telekom Ventures and the TT Ventures Venture Capital Investment Fund support their portfolio companies with marketing, infrastructure, and business development, driving growth and global expansion.

Segmentify stands out by offering AI solutions that enhance real-time data analysis, particularly in e-commerce, helping businesses create personalized interactions with visitors and optimize their marketing strategies.

Founded in 2015, Segmentify now serves over 300 clients across more than 30 countries.

Itır Ürünay Aydoğan, director of ecosystem and innovation at private lender Yapı Kredi, emphasized the importance of enabling Turkish startups to compete on a global scale, stressing their ventures program FRWRD.

Speaking about their focus on international events during the startups.watch meeting, Aydoğan said last year, they participated in key events in Finland and Estonia, two countries that have made significant contributions to the startup ecosystem.

“Now, we're looking to make an even greater impact by supporting entrepreneurs at a larger event in Portugal. The WebSummit, which takes place in Lisbon this November, brings together startups from all over the world. With increased national support, we believe this will offer tremendous benefits to our entrepreneurs."