© Turkuvaz Haberleşme ve Yayıncılık 2025

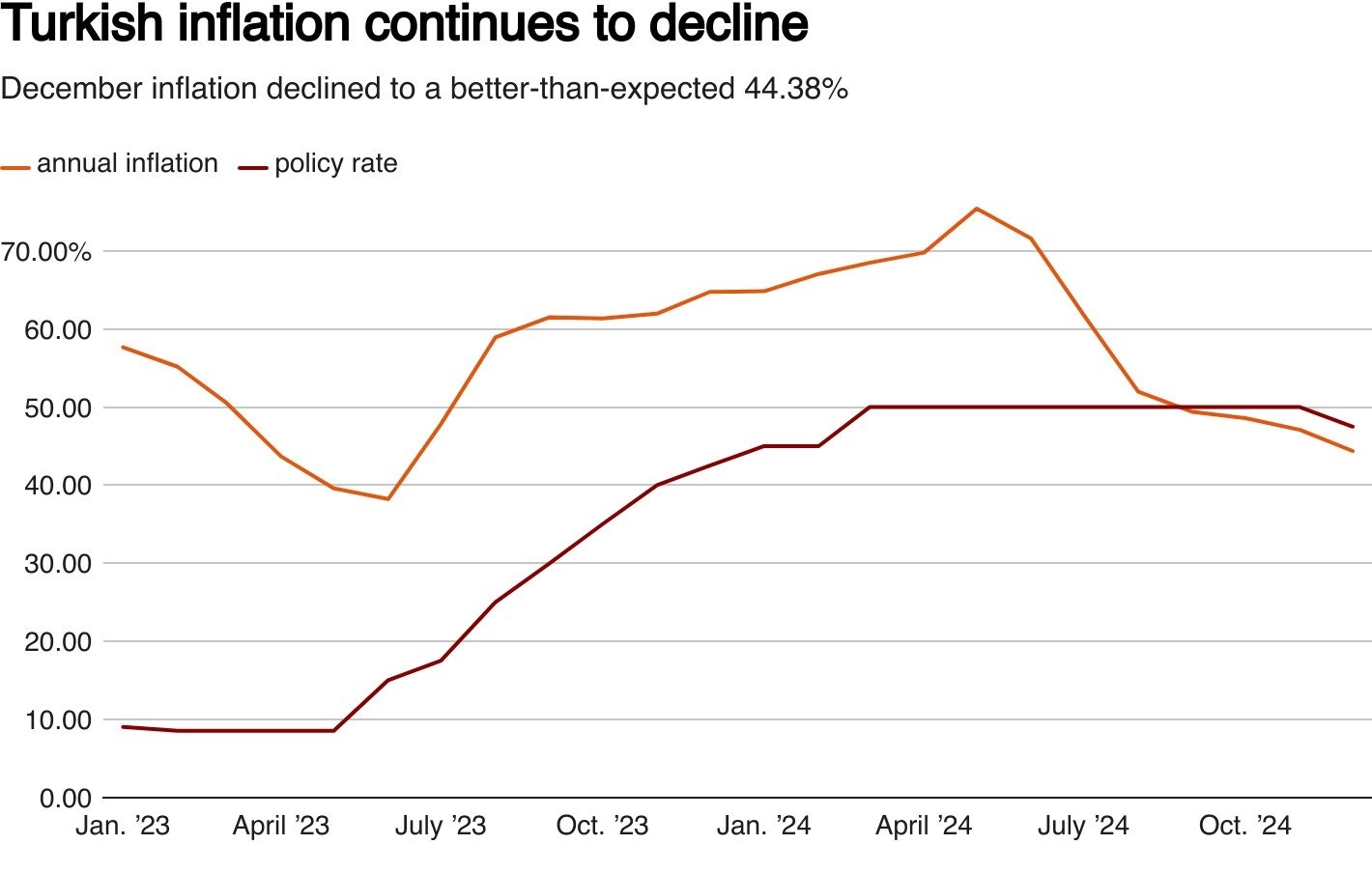

Türkiye's annual inflation cooled more than expected in December to mark a seventh consecutive drop that put the year-end figure largely in line with the estimation of the country’s central bank, which launched an easing cycle last month after an extended battle to cool growth in prices.

Consumer prices rose by nearly 44.4% on an annual basis last month, the Turkish Statistical Institute (TurkStat) said, the lowest level in one-and-a-half years amid a slowdown in costs for a wide number of categories.

Market surveys saw annual inflation falling to about 45.2% from 47.1% in November. The December figure marks the weakest inflation since June 2023, when prices had risen 38.21%.

On a monthly basis, consumer prices increased 1.03% in December, way slower than expected after a 2.24% gain in November. Surveys estimated a rise of about 1.6%.

The latest inflation print hit the central bank's midpoint target of 44% for year-end.

The bank, having kept its main interest rate steady at 50% since March, launched an easing cycle last week, cutting the policy rate by 250 basis points to 47.5%. It had begun tightening policy in mid-2023. The last cut was in February 2023.

The bank said it will set policy "prudently" meeting by meeting with a focus on the inflation outlook while responding to any expected "significant and persistent deterioration."

With the decline in inflation, the central bank is seen to continue with the rate cuts this year, economists say.

The larger-than-expected fall last month "points towards another 250bp interest rate cut, to 45.0%, at the next central bank meeting on 23rd January," said William Jackson, chief EM Economist at Capital Economics.

Treasury and Finance Minister Mehmet Şimşek said the inflation rate had fallen "by 20 points compared to the end of 2022 and 2023."

Şimşek expressed confidence that it will keep falling and hit this year's targets "with the increasing support of fiscal policy, the decrease in rigidity in services inflation and the improvement in expectations."

"Solving our citizens' financial difficulties is our top priority. In this respect, we have established the necessary policy framework and are continuing to implement the disinflation program with utmost determination," he wrote on social media platform X.

The central bank sees inflation falling to 21% at the end of this year.

Education, housing and restaurant prices led the rise in the annual print while furniture and telecoms-related prices were up the most from the previous month, according to data.

Among categories, the annual price growth in food and nonalcoholic beverages eased to 43.58% from 48.57%. Similarly, inflation based on utilities moderated to 69.03% from 74.45%. On the other hand, prices for clothing and footwear rose at an accelerated pace of 32.32%.

Furniture prices rose 2.78% from the previous month, data showed, while telecoms-related prices gained by 1.82%.

Evaluating the data, Vice President Cevdet Yılmaz emphasized the government’s commitment to strengthening the disinflation process, advancing social welfare, increasing predictability in the economy, and ensuring a fair and efficient distribution of resources.

"The course of inflation expectations is crucial for the speed of disinflation. With the policies we will implement in the coming period, we will accelerate the improvement in inflation expectations and further strengthen the disinflation process," Yılmaz wrote on X.

He also highlighted the improvement in service inflation, known for high backward pricing, particularly in the last quarter.

Prices in coming months will be affected by new year administered hikes and the 30% rise in minimum wage, which was less than requested by workers.

While most taxes and fees are updated with the usual inflation coefficient in 2025, the government hiked a tax on fuel, which has a major impact on overall prices, by a lower 6% as of January as part of the disinflation program.

Separate data from the statistical office showed that producer price inflation also eased to a 45-month low of 28.52% in December from 29.47% in the prior month.

Monthly, producer prices edged up 0.4% versus a 0.66% increase in November.

Among the main sectors, prices for the mining and quarrying sector grew 36.17% from last year, and those for manufacturing rose by 11.21%.

Yılmaz said the moderate trend in domestic producer prices continues to alleviate cost pressures on consumer prices, significantly weakening price increases in essential goods.

"We observe a clear improvement in firms' pricing behaviors," he added. He said the producer price inflation has dropped by 29.2 points since the start of the disinflation program and 15.7 points compared to the previous year.

The Turkish lira was little changed after the data at 35.3850 to the dollar, hovering around the record lows.